Life Insurance Can Be Fun For Everyone

Table of ContentsNot known Factual Statements About Life Insurance Some Known Questions About Life Insurance.Top Guidelines Of Life InsuranceLife Insurance Can Be Fun For EveryoneHow Life Insurance can Save You Time, Stress, and Money.The Facts About Life Insurance Revealed

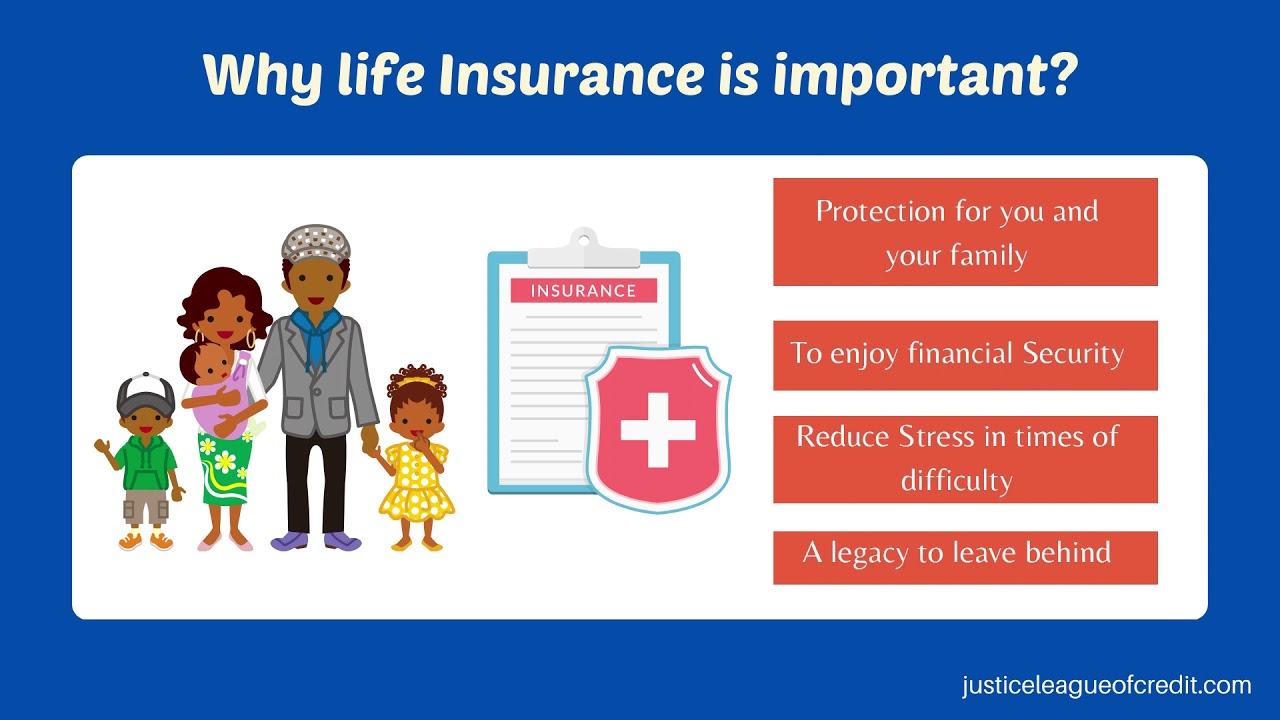

As we expand older, get wed, develop family members and start organizations, we pertain to understand an increasing number of that life insurance policy is a fundamental component of having a sound financial strategy. Relying on your kind of plan, life insurance policy is rather affordable, which means there's no reason not to obtain insurance coverage currently.Here are a few other reasons that living insurance is essential - life insurance. If your loved ones depend upon your economic support for their income, after that life insurance policy is a must, because it replaces your earnings when you die. This is particularly essential for moms and dads of children or adults that would certainly find it tough to maintain their criterion of living if they no more had accessibility to the earnings supply by their companion.

Even if you do not have any type of other properties to pass to your beneficiaries, you can develop an inheritance by buying a life insurance coverage policy and also calling them as recipients. This is a wonderful method to establish your kids up for a strong economic future as well as provide for any type of financial needs that will emerge.

All About Life Insurance

Therefore, added insurance coverage is definitely essential while your children are still at home. We can not know when we'll pass away. Maybe today, tomorrow or 50 years from currently, however it will certainly take place eventually. No amount of cash might ever replace an individual. More than anything, life insurance policy can aid supply security for the uncertainties in life.

It's one point you can be certain of and you'll no more have to question whether they'll be looked after when you're gone. Life insurance policy secures your successors from the unidentified as well as aids them through an or else tough time of loss.

The Greatest Guide To Life Insurance

Some of the most typical reasons for getting life insurance include: Guaranteed protection, If you have a family, a service, or others who rely on you, the life insurance policy benefit of a whole life plan works as an economic safety net. When you die, your beneficiaries will certainly obtain a lump-sum payment that is guaranteed you could look here to be paid in complete (supplied all costs are paid as well as there are no impressive finances).

Earnings replacement, Imagine what would take place to your household if the income you provide suddenly gone away. With whole life insurance policy, you can aid make certain that your liked ones have the cash they require to assist: Pay the home mortgage Afford child care, healthcare, or various other solutions Cover tuition or various other university expenses Eliminate household financial debt Maintain a family members service 3.

Your agent can aid you choose if any one of these bikers are appropriate for you.

Some Known Details About Life Insurance

Life insurance policy exists to aid safeguard your family from economic challenge. Here are a few other reasons to take into consideration. Life insurance policy can commonly be confusing. Lots of people recognize what it is, yet they aren't truly sure why they might need a policy - life insurance. This can cause individuals delaying obtaining a plan or, even worse, not obtaining one at all.

Additionally, bear in mind, if you are a stay-at-home parent, the worth you provide through your work with your youngsters click for source and in the house is essential. If you were to pass away, your spouse would need to pay for the solutions you provide taking imp source care of your household. Life insurance policy is essential also if you do not have a spouse or kids.

What Does Life Insurance Do?

The same holds true for spending for expenses as well as other sorts of financial debt. If you die with debt card financial debt or a vehicle loan, for instance, then that debt doesn't vanish someone will certainly have to pay for it. In a lot of cases, that might be your spouse or companion, as well as, if you are solitary, your parents or siblings.

Your life insurance plan can likewise assist pay for your funeral service and also funeral. This can assist reduce the worry your liked ones might encounter trying to spend for it. When a liked one passes away, it's always an emotional as well as stressful time. This currently challenging period can be extra difficult if there are worries about changing income and also covering costs.

Knowing they have your fatality advantage to cover the mortgage, for instance, can give your spouse the moment they need to progress at their own rate. There are a great deal of factors why people believe they do not need life insurance. Here are several of the most common misconceptions and excuses as well as why they might not include up.

Get This Report on Life Insurance

While that's an excellent beginning, oftentimes, it will not be sufficient for your liked ones to replace your income over the long-term. And also, if you leave your job, that policy often will not take a trip with you. There are a great deal of various types of life insurance policy plans, making it feasible for virtually anybody to find something in their budget.

Life insurance policy can often feel like a confusing subject. Sitting with a monetary expert or life insurance coverage agent can be actually practical. They can stroll you through the plans that finest fit your needs and also aid you find out just how much insurance coverage you should have. Life insurance should not be something that you take a look at as part of your retired life plan.